Table of Contents

The Employment and Support Allowance (ESA) Support Group provides vital financial help for those unable to work due to long-term health conditions.

However, eligibility particularly for income-related ESA can be influenced by how much savings a claimant holds.

Understanding the rules around savings thresholds is essential to avoid unexpected benefit reductions or disqualification.

This guide explains how different levels of savings affect ESA Support Group entitlement and highlights the differences between contribution-based and income-related ESA options.

What is the ESA Support Group and Who Qualifies?

The ESA Support Group is a category under the Employment and Support Allowance scheme for individuals with long-term illnesses or disabilities that prevent them from working.

It is designed for those who have been medically assessed and found to have limited capability for work-related activity.

Once placed in the Support Group, claimants are not required to engage in job-seeking activities or attend work-related interviews.

This makes it particularly suitable for individuals with severe health conditions that are unlikely to improve in the short term.

Qualification for the Support Group depends on the Work Capability Assessment conducted by the Department for Work and Pensions (DWP).

If the claimant meets the necessary medical criteria, they will be placed in the Support Group. This decision allows them to receive additional financial support and protection from time-limited payments that apply to other ESA groups.

What Are the Two Types of ESA and How Do They Differ?

Employment and Support Allowance is offered in two distinct types:

- Contribution-based ESA, which is available to individuals who have made sufficient National Insurance contributions over the past two to three tax years.

- Income-related ESA, which is means-tested and based on the claimant’s income and capital, including savings.

Contribution-based ESA does not take savings into account when assessing eligibility. Instead, it relies solely on the individual’s contribution history.

In contrast, income-related ESA looks at the total financial circumstances of the claimant, including income from all sources, savings, and capital. This makes understanding the differences between the two types essential when applying.

While contribution-based ESA is often limited to 12 months, claimants placed in the Support Group can continue receiving it beyond this time limit, provided their condition remains unchanged. Income-related ESA can continue as long as eligibility requirements are met.

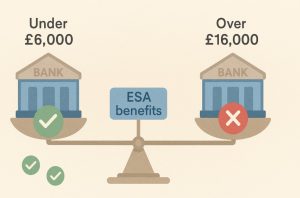

How Do Savings Affect Income-Related ESA?

Savings and capital play a significant role in determining eligibility and payment amounts for income-related Employment and Support Allowance (ESA).

Unlike contribution-based ESA, which is not means-tested, income-related ESA takes into account your entire financial situation.

This includes your income, your partner’s income (if applicable), and any savings or investments you hold.

The Department for Work and Pensions (DWP) has set clear thresholds for how savings affect entitlement to income-related ESA.

These savings are referred to as “capital” and include a wide range of financial assets such as:

- Cash savings in bank or building society accounts

- Investments such as shares or bonds

- National Savings accounts and certificates

- Money held in ISAs (excluding Lifetime ISAs under certain conditions)

- Property (other than your main home), including land

- Any lump-sum payments, such as inheritance or redundancy pay

The DWP uses a notional income calculation to determine how savings above a certain amount reduce your benefit.

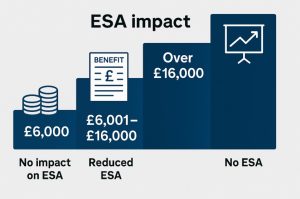

Capital Limits and Reductions

There are three main savings thresholds that determine how much, if anything, you’ll receive from income-related ESA:

- Savings under £6,000: If your total capital is below £6,000, it will not affect your ESA payments at all. You will be treated as having no additional income from your savings, and your entitlement will be calculated based on other factors such as income and health condition.

- Savings between £6,001 and £16,000: When savings fall within this range, the DWP applies a tapered reduction. For every £250 (or part of £250) above £6,000, the DWP assumes you have a weekly notional income of £1, which is deducted from your ESA entitlement. This means that even if you’re not earning interest on those savings, they are still treated as generating income in the DWP’s assessment.

Example Calculation:

If you have £9,000 in savings:

- Amount over the £6,000 threshold = £3,000

- Divide £3,000 by £250 = 12

- Notional weekly income = £12

- Your weekly ESA payment would be reduced by £12

- Savings over £16,000: If your savings exceed £16,000, you are not eligible for income-related ESA. This rule applies even if you have no other income or are in the Support Group.

This sliding scale system is designed to ensure that income-related ESA is only provided to those who do not have sufficient capital to support themselves.

Types of Capital That May Be Disregarded

Not all savings count towards these thresholds. Some types of capital can be disregarded, either fully or for a limited time. Examples include:

- Personal injury compensation held in a personal injury trust

- Payments from certain charitable trusts

- Arrears of other benefits, which are usually disregarded for 52 weeks

- The value of the home you live in

- Savings belonging to children in your household

These exceptions help ensure that people with complex financial backgrounds or those receiving specific types of support are not unfairly penalised.

How the Rules Apply to Couples?

For couples making a joint ESA claim, savings and capital are assessed jointly. If the total capital held between both partners exceeds the £6,000 or £16,000 limits, it will affect the claim in the same way as for a single claimant.

This means that if only one person is applying for ESA but lives with a partner, the partner’s savings will still be taken into account. This can significantly affect eligibility and the level of financial support available.

How Do Savings Impact Contribution-Based ESA?

Savings do not affect entitlement to contribution-based ESA. This type of ESA is granted based on the claimant’s National Insurance contribution record, not their financial assets.

Even if an individual has substantial savings, they can still qualify for contribution-based ESA, provided they meet the National Insurance contribution conditions. This makes it a more suitable option for those who have been in long-term employment and have built up savings or other financial resources.

The only exception to this is if the individual also receives income-related ESA as a top-up. In such cases, the savings rules for income-related ESA will apply to the additional payments.

What Is the Savings Threshold for ESA Support Group?

The Support Group component of ESA can apply to either type of ESA, but the savings thresholds only apply to the income-related variant. The DWP assesses the capital and savings held by claimants to determine how much ESA they are entitled to receive.

Below is a table that outlines how savings affect eligibility and payment amounts for income-related ESA:

| Savings Amount | Effect on ESA Payments |

| £0 to £6,000 | Full payment; no reduction applies |

| £6,001 to £16,000 | Payment reduced by £1 for every £250 over £6,000 |

| Over £16,000 | No entitlement to income-related ESA |

This capital limit includes money held in bank accounts, savings accounts, cash ISAs, investments, and other accessible financial products.

Some savings may be disregarded under specific conditions, such as those held in trust after a personal injury settlement.

How Does ESA Compare to Universal Credit When It Comes to Savings?

Universal Credit (UC) is a broader benefit that combines several legacy benefits, including income-related ESA, into one monthly payment. The savings rules under UC are similar to those under income-related ESA, but it’s important to understand the distinctions, especially for those transitioning from ESA to UC.

| Savings Range | Universal Credit Impact |

| £0 to £6,000 | No impact on payment amount |

| £6,001 to £16,000 | Gradual reduction in benefit through assumed monthly income |

| Over £16,000 | No entitlement to Universal Credit |

Unlike ESA, Universal Credit assesses income and capital on a household basis, which includes partners. For many ESA claimants, especially those in the Support Group, switching to Universal Credit may not be beneficial due to potential reductions in entitlement.

What Happens If Your Savings Go Over the Limit?

When savings increase beyond the £16,000 limit for income-related ESA, the claimant becomes ineligible for this benefit.

This situation can occur due to inheritance, compensation payments, or sale of assets. It is the claimant’s responsibility to inform the DWP of any change in financial circumstances.

If the change is not reported promptly, it can result in overpayments. The DWP may recover these funds and apply sanctions for failure to disclose.

In some cases, criminal charges may be considered, especially if the omission appears deliberate.

For those whose savings only temporarily exceed the limit, it may be possible to reclaim ESA once savings fall back below the threshold. However, new assessments may be required in such cases.

How Can You Maximise Your ESA While Having Savings?

There are lawful methods that claimants can use to manage their savings without losing eligibility for ESA. These strategies can help individuals maintain financial stability while still receiving the support they need.

- Use savings for essential, disability-related expenses such as home modifications, medical equipment, or mobility aids

- Consider placing compensation money into a Personal Injury Trust, which is not counted as capital for benefits

- Seek professional financial advice to plan around the savings rules

Claimants must avoid any actions that could be considered deliberate deprivation of capital. This includes giving away money or spending it recklessly with the intention of qualifying for benefits.

What Other Benefits Can You Get Alongside ESA?

Claimants in the ESA Support Group may be entitled to additional benefits depending on their circumstances. These include:

- Housing Benefit, which can help cover rental costs for those not on Universal Credit

- Council Tax Reduction, offered by local authorities to help lower council tax bills

- Personal Independence Payment (PIP), which supports individuals with extra costs due to long-term disability or health conditions

Eligibility for these benefits may be influenced by income and savings, although PIP is not means-tested. Each benefit should be considered individually to understand its specific rules regarding financial resources.

Are There Any Exceptions or Special Rules?

There are specific exceptions and special considerations that apply to ESA savings rules in certain scenarios. These rules are intended to provide additional protection to particularly vulnerable claimants or those facing unique circumstances.

- Joint claims for couples are assessed based on combined savings, meaning that even if only one person is claiming, both partners’ savings are considered

- Certain forms of income and capital are disregarded, such as personal injury compensation held in a trust or payments made to children

- Claimants with a terminal illness may be fast-tracked into the Support Group and receive additional support without undergoing the usual Work Capability Assessment

Special rules also apply to war pensions, charitable payments, and other specified income sources.

The DWP provides guidance on what is considered disregarded capital, and claimants are encouraged to seek professional advice when in doubt.

Conclusion

Savings can significantly impact eligibility for income-related ESA, especially within the Support Group.

While contribution-based ESA remains unaffected by capital, most claimants must understand the £6,000 and £16,000 thresholds to maintain entitlement.

Reporting savings accurately and exploring legal ways to manage them are essential steps in ensuring continuous support.

FAQs

Can I claim ESA support group if I have a joint savings account?

Yes, but the DWP will treat joint savings as being equally owned. If the total exceeds the limit, your benefit may be reduced or stopped.

Does owning property affect my ESA entitlement?

If the property is your main residence, it won’t affect your claim. However, second properties or rental income may be considered.

Is there a way to protect my savings from affecting benefits?

Certain types of savings, such as personal injury compensation held in a trust, may be disregarded. Legal advice is recommended.

Do I need to report changes in my savings immediately?

Yes. Failing to report changes could result in overpayments or fraud investigations.

How often does the DWP review savings for ESA claimants?

Reviews are conducted periodically or when changes are reported. You must declare accurate savings at each review.

What happens if I inherit money while on ESA?

An inheritance must be reported immediately. If it pushes your savings over £16,000, your income-related ESA will be stopped.

Are there different ESA rules for pensioners with savings?

Once you reach State Pension age, ESA stops. Other benefits like Pension Credit may be available, with different savings rules.