Table of Contents

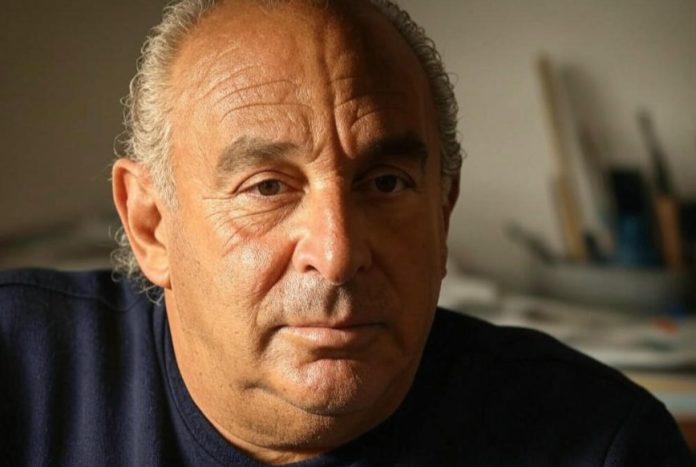

Sir Philip Green is a well-known but controversial figure in the UK business world, particularly in the retail sector. With a career spanning over five decades, he built a retail empire that included iconic brands such as Topshop, Dorothy Perkins, and Miss Selfridge.

Despite his remarkable business acumen, Green’s legacy has been tarnished by financial scandals, ethical controversies, and the collapse of major retail institutions like BHS and Arcadia.

In this post, we explore Green’s rise to fame, his fortune, and the controversies that have shaped his reputation.

Who Is Sir Philip Green and Why Is He a Notable Figure in UK Business?

Sir Philip Nigel Ross Green, born on 15 March 1952 in Croydon, England, is a prominent figure in the British business world, particularly within the retail sector.

Over the course of a career spanning more than five decades, Green rose from humble beginnings to become one of the UK’s most well-known and controversial businessmen.

His reputation was built on bold acquisitions, aggressive business strategies, and a deep understanding of the high street retail market.

Green’s early years were marked by both opportunity and hardship. His father, Simon Green, was a successful property developer and retail business owner, but passed away when Philip was just twelve years old.

Following this, Green left school at the age of 15 without completing his O-levels and entered the world of work through the fashion import business.

By the age of 21, he had already established his first venture, importing jeans from the Far East and supplying London retailers — a move that set the tone for his future in the clothing industry.

Throughout the 1980s and 1990s, Green gained a reputation for turning around struggling companies. His ability to identify underperforming businesses and revitalise them with lean operational models led to his eventual takeover of British Home Stores (BHS) in 2000, followed by Arcadia Group in 2002.

At its peak, the Arcadia Group controlled some of the UK’s most recognisable fashion brands, including Topshop, Topman, Dorothy Perkins, and Miss Selfridge.

Outside of business, Green has been married to Cristina Palos (commonly known as Tina Green) since 1990, and the couple has two children.

His knighthood in 2006 for services to the retail industry cemented his place in British corporate history, though his legacy has since become more complex due to financial controversies and ethical scrutiny.

What Was Philip Green’s Peak Net Worth and How Did He Build His Fortune?

Green’s wealth peaked during the early 2000s, driven by Arcadia’s retail success and strategic acquisitions. The cornerstone of his fortune came from buying undervalued companies, restructuring them, and maximising short-term profit.

A key moment in his financial ascent was the 2005 £1.2 billion dividend payout to his wife Tina Green, who was the sole shareholder of Taveta Investments, Arcadia’s parent company.

This payout was not subject to UK tax, as Tina resided in Monaco. It remains one of the largest private payments in UK corporate history and became symbolic of the Greens’ tax-efficient structuring.

His retail empire included a broad spectrum of popular high street clothing stores:

- Topshop and Topman: Flagship youth fashion brands with international recognition

- Burton and Dorothy Perkins: Long-established brands serving mass-market shoppers

- Evans and Wallis: Retailers catering to specific demographics such as plus-size women or older audiences

- Outfit: Multi-brand stores showcasing Arcadia’s portfolio under one roof

At his peak, Green was regularly featured in the Sunday Times Rich List and various Forbes rankings. The diversity of his holdings, paired with a vertically integrated supply chain and private ownership, kept Arcadia highly profitable for several years.

How Has Philip Green’s Net Worth Changed Over the Years?

Philip Green’s net worth has experienced substantial erosion since its peak. While once estimated at nearly £5 billion, his current wealth is believed to have declined to around £800 million in 2025.

This decline is attributed to several key factors:

- Collapse of BHS: The once-prominent British retailer was sold by Green in 2015 for just £1. The company failed within a year, leaving behind a pension deficit of £571 million. The scandal sparked political outrage and damaged his reputation.

- Arcadia’s Decline and Administration: As consumer shopping habits shifted online, Arcadia struggled to compete with fast-fashion giants like ASOS, Boohoo, and Zara. The COVID-19 pandemic further accelerated the group’s downfall, leading to its administration in late 2020.

- Asset Liquidation and Brand Sales: Topshop, Topman, and Miss Selfridge were sold to ASOS in 2021. Other Arcadia brands were acquired by Boohoo, but Green was not directly involved in or benefitting significantly from these sales, as Taveta Investments was already in crisis mode.

- Legal and Financial Settlements: Green paid £363 million into the BHS pension fund voluntarily after facing parliamentary scrutiny and potential legal action. Although it helped avoid losing his knighthood, it significantly reduced his liquid assets.

Despite these setbacks, Green retains considerable wealth due to his offshore structures, luxury assets, and remaining investments.

What Are the Assets and Properties That Contribute to His Wealth?

Philip Green’s tangible assets have long been the cornerstone of his personal fortune, particularly as his retail businesses began to flounder.

Among his most prominent assets:

- Lionheart Yacht: A 90-metre Benetti-built superyacht, Lionheart, is estimated to be worth over £100 million. The yacht is known for its opulence and is frequently docked in the Mediterranean.

- Gulfstream G550 Private Jet: Estimated at £20 million, this jet has been used for both personal and business travel. It has drawn criticism in the past, especially when juxtaposed with layoffs and furloughs at Arcadia.

- Monaco Apartment: Green and his wife live in Monaco, a location known for its favourable tax laws. The residence not only provides a luxurious lifestyle but also acts as a strategic base for financial planning.

- London Properties: Green owns multiple commercial and residential properties in London. While many of his retail stores were leased, some of the real estate assets linked to Arcadia were owned directly or via separate companies.

- Offshore Holdings: Tina Green, as a Monaco resident and Arcadia’s main shareholder, holds various offshore accounts and investments. These remain private, but their value is believed to constitute a large part of the family’s remaining wealth.

Even after the commercial failure of his retail empire, these assets have allowed the Greens to maintain a lifestyle far removed from the financial pressures felt by former Arcadia employees or pensioners.

How Did the Collapse of BHS and Arcadia Affect His Wealth?

The fall of BHS and Arcadia are arguably the two most defining moments of Philip Green’s career — not just due to their financial implications but also due to the long-term damage to his public image.

BHS Collapse

- Acquired in 2000 for £200 million

- Sold in 2015 for £1 to a little-known financier, Dominic Chappell

- Entered administration in 2016, leaving 11,000 people out of work and a massive pensions shortfall

- £586 million was extracted by the Green family in dividends and interest over their 15-year ownership

- Parliamentary committees described his behaviour as morally unacceptable and called for his knighthood to be rescinded

After prolonged scrutiny, Green agreed to a voluntary settlement of £363 million to partially resolve the pension deficit, but the damage to his credibility was irreversible.

Arcadia Administration

- Entered administration in November 2020

- COVID-19 lockdowns accelerated existing financial troubles

- Brands like Topshop, Topman, and Miss Selfridge were sold off with no financial gain for Green

- Over 13,000 jobs were affected

- The administration meant most creditors were unlikely to be fully repaid

Combined, these events eroded billions in company valuation and shifted Green’s profile from retail mogul to controversial businessman.

What Controversies Have Affected Philip Green’s Public Image and Finances?

Philip Green has been at the centre of multiple high-profile controversies over the years, significantly impacting both his public image and business reputation.

Tax Avoidance

The structure of Arcadia’s ownership through Taveta Investments — registered in Tina Green’s name in Monaco — allowed significant tax savings. The £1.2 billion dividend paid in 2005 was tax-free, drawing criticism and leading to activist protests by UK Uncut.

BHS Pensions Scandal

Green’s decision to sell BHS for £1 raised suspicions, especially after the firm collapsed under a massive pensions liability. MPs accused him of asset stripping and failing in his duties as a company director.

Sexual Harassment Allegations

In 2018, The Daily Telegraph attempted to expose allegations of bullying, racism, and sexual harassment by Green. Though an injunction initially suppressed the report, he was later named in the House of Lords under parliamentary privilege. The fallout included calls to strip him of his knighthood and widespread criticism from media and the public.

Political Connections

Green was asked by then-Prime Minister David Cameron to conduct a review of government procurement. While his report highlighted key inefficiencies, the appointment itself was questioned due to his controversial business dealings.

These controversies, along with protests and media scrutiny, led to significant reputational damage and loss of trust within the business community.

What Is Philip Green’s Philanthropic Impact and Public Service Record?

Despite the controversies, Green has been involved in numerous charitable and philanthropic efforts.

- Donated £250,000 as a reward for information in the Madeleine McCann case

- Provided financial aid to the Royal Marsden Cancer Hospital

- Supported Fashion Retail Academy and Retail Trust

- Contributed to the Evening Standard’s Dispossessed Fund

He was also tasked with reviewing UK government procurement processes in 2010, producing a report that highlighted significant inefficiencies.

How Does Philip Green Compare to Other UK Retail Tycoons in 2025?

| Name | 2025 Estimated Net Worth | Main Brands |

| Sir Philip Green | ~£800 million | Former: Arcadia, Topshop |

| Mike Ashley | ~£2.5 billion | Sports Direct, House of Fraser |

| Mahmud Kamani | ~£1.1 billion | Boohoo, PrettyLittleThing |

| Richard Branson | ~£3.0 billion | Virgin Group |

Green once towered above other UK retail figures, but due to market shifts and financial missteps, his ranking has diminished.

What Can We Learn from the Rise and Fall of Sir Philip Green’s Empire?

Green’s journey offers key insights for aspiring entrepreneurs and established business leaders alike:

- Success in business often depends on adaptability. Green’s late pivot to online retail hurt Arcadia’s long-term viability.

- Ethical leadership matters. His handling of BHS pensions and tax practices undermined public trust.

- Reputation is critical. A single controversy, especially in the digital age, can have long-lasting consequences.

Ultimately, Green’s story reflects both the rewards and pitfalls of rapid retail expansion and aggressive financial structuring.

Conclusion

The rise and fall of Sir Philip Green serve as a cautionary tale about the complexities of wealth, business strategy, and public perception.

His success in building a retail empire was overshadowed by ethical missteps, financial scandals, and legal battles. Today, Green’s net worth stands at a fraction of its peak, with his legacy marked by both his bold business strategies and the controversies that followed.

His story offers valuable lessons for aspiring entrepreneurs, particularly in the importance of ethics, adaptability, and reputation in business.

FAQs About Philip Green’s Net Worth

How much is Sir Philip Green worth in 2025?

Philip Green’s net worth in 2025 is estimated to be around £800 million, significantly lower than his peak, due to the collapse of BHS and Arcadia Group.

Did Arcadia Group’s collapse ruin Philip Green financially?

While it severely reduced his retail empire, Green retains substantial wealth through offshore assets, luxury possessions, and property holdings.

Is Philip Green still involved in any business ventures?

As of 2025, there is no public indication that Green is actively involved in major new ventures. His public business activity has been minimal since Arcadia’s fall.

How does his lifestyle in Monaco influence his tax situation?

Living in Monaco has allowed Green’s family to benefit from favourable tax laws, particularly through his wife Tina Green, under whose name much of his wealth is registered.

What led to the controversy over the BHS pension fund?

BHS collapsed with a £571 million pension deficit, while the Greens had taken hundreds of millions in dividends. This created public and parliamentary backlash.

Why was Philip Green criticised for tax avoidance?

Green structured his businesses so that profits were paid to his Monaco-resident wife, legally avoiding UK tax obligations on large corporate payouts.

Has Philip Green’s knighthood ever been revoked?

Though there were official calls and parliamentary votes to remove his knighthood, the title has not been officially revoked as of 2025.