Table of Contents

As of 2026, Jensen Huang’s net worth is estimated at around $164 billion, placing him among the world’s wealthiest technology leaders. When I analyse executive wealth, I focus less on static headline figures and more on the structural reasons behind sudden increases. In Huang’s case, the explanation is unusually clear.

His fortune is overwhelmingly tied to NVIDIA, a company he co-founded in 1993 and has led continuously ever since. Unlike many technology billionaires who diversify early into media, real estate, or venture capital, Huang’s wealth has grown almost entirely through long-term ownership of a single company that has become foundational to the global AI economy.

What makes 2026 especially significant is that NVIDIA crossed a symbolic and financial threshold. With a market capitalisation exceeding $5 trillion, even small share price movements now translate into multi-billion-dollar changes in Huang’s personal net worth.

Who Jensen Huang Is and Why His Background Still Matters?

Jensen Huang was born in Taipei in 1963 and moved to the United States as a child. His early years were marked by cultural displacement and hardship, including time spent at a reform-style boarding school in Kentucky. These experiences are often referenced by colleagues and analysts when describing his unusually high tolerance for risk and long-term pressure.

Academically, Huang moved quickly. He graduated from high school at just 16, earned a degree in electrical engineering from Oregon State University, and later completed a master’s degree at Stanford University. Before founding NVIDIA, he worked at AMD, gaining first-hand experience in chip design and large-scale semiconductor operations.

NVIDIA itself was not an overnight success. The company nearly collapsed several times in its early years. Huang has openly stated that survival, not dominance, was the initial goal. That survival mindset later shaped NVIDIA’s willingness to make counterintuitive bets on computing architectures that the broader market initially dismissed.

Why Jensen Huang’s Wealth Accelerated So Rapidly by 2026?

Between 2023 and 2026, Huang’s net worth increased at a pace rarely seen outside platform monopolies. The reason was not speculative enthusiasm but structural dependency.

By the mid-2020s, NVIDIA had become the default supplier of advanced AI computation. Its GPUs were no longer optional performance upgrades but core infrastructure for training and deploying large-scale artificial intelligence systems across healthcare, finance, defence, logistics, and consumer technology.

Huang owns roughly 3.6 percent of NVIDIA, a stake that has remained relatively stable for years. What changed was valuation. As governments, cloud providers, and enterprises committed long-term capital to AI infrastructure, NVIDIA’s revenue visibility improved dramatically. Markets responded by pricing NVIDIA less like a cyclical chip company and more like essential digital infrastructure.

The Blackwell Architecture and the Core 2026 Wealth Driver

The most important contributor to Jensen Huang’s 2026 net worth was NVIDIA’s Blackwell GPU architecture. This was not simply a generational hardware upgrade. Blackwell fundamentally altered how AI systems could be trained and deployed at scale.

From a financial perspective, Blackwell mattered because it reduced operational costs for customers while increasing NVIDIA’s pricing power. Data centres could achieve higher performance with fewer chips, but those chips were so critical that customers were willing to pay a premium.

Equally important was ecosystem lock-in. NVIDIA’s CUDA software stack and AI tooling meant that hardware decisions were no longer isolated purchases. Once companies standardised on NVIDIA’s platform, switching costs became extremely high. This reinforced long-term demand and stabilised revenue expectations, a key factor in NVIDIA’s valuation surge.

Jensen Huang’s Net Worth Growth in Context

| Year | NVIDIA Market Cap | Estimated Huang Net Worth |

| 2019 | $100 billion | $3 billion |

| 2021 | $500 billion | $16 billion |

| 2023 | $1.8 trillion | $65 billion |

| 2024 | $3 trillion | $100 billion |

| 2025 | $5 trillion | $152 billion |

| 2026 | $5.1 trillion | $164 billion |

This progression closely mirrors NVIDIA’s expansion into AI data centres and sovereign computing projects rather than consumer markets, which tend to be more volatile.

Where Jensen Huang’s Income Actually Comes From?

Despite frequent media focus on CEO pay packages, Huang’s salary represents a negligible portion of his overall wealth. His financial profile is dominated by equity appreciation.

| Income Source | Estimated Value |

|---|---|

| NVIDIA share appreciation | $130B+ |

| Stock options and dividends | ~$8B |

| Annual executive compensation | ~$30M |

| Real estate assets | ~$200M |

| Private investments | ~$500M |

More than ninety percent of his net worth remains exposed to NVIDIA’s long-term performance. This level of concentration is unusual but underscores how closely Huang’s personal outcome is tied to the company’s strategic direction.

The Often-Ignored 2026 Tax Dimension

One area that net-worth articles frequently overlook is tax exposure. In 2026, renewed debate around a California-level billionaire wealth tax placed Huang among a very small group of individuals potentially facing multi-billion-dollar liabilities.

Depending on how thresholds and unrealised gains are treated, analysts estimate Huang’s potential exposure could exceed $8 billion over several years. While this does not materially threaten his financial position, it has implications for how and when shares are sold, transferred, or placed into trusts.

This context also helps explain the growing scale and visibility of the Jen-Hsun & Lori Huang Foundation, which plays a role in both philanthropy and long-term estate planning.

NVIDIA’s Strategic Partnerships and Supply Chain Advantage

Another factor supporting Huang’s sustained wealth is NVIDIA’s manufacturing and ecosystem strategy. The company’s deep relationship with TSMC allows it to secure leading-edge fabrication capacity that many competitors struggle to access.

By aligning closely with manufacturing partners and systems integrators, NVIDIA has reduced supply-chain uncertainty at a time when global chip capacity remains constrained. Investors reward this stability, particularly when paired with long-term AI infrastructure contracts.

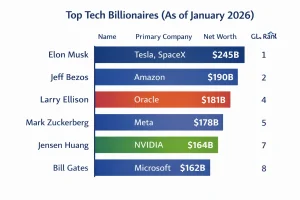

How Jensen Huang Compares to Other Tech Billionaires in 2026?

| Name | Primary Company | Net Worth | Global Rank |

|---|---|---|---|

| Elon Musk | Tesla, SpaceX | $245B | 1 |

| Jeff Bezos | Amazon | $190B | 2 |

| Larry Ellison | Oracle | $181B | 4 |

| Mark Zuckerberg | Meta | $178B | 5 |

| Jensen Huang | NVIDIA | $164B | 7 |

| Bill Gates | Microsoft | $162B | 8 |

What distinguishes Huang is not just absolute wealth but velocity. His net worth expanded more than fifteen-fold in under a decade, driven almost entirely by infrastructure-level technology adoption rather than consumer platforms.

Philanthropy and Long-Term Influence

Jensen Huang and his wife founded the Jen-Hsun & Lori Huang Foundation in 2007. An initial contribution of NVIDIA shares has grown into a foundation managing assets estimated above $12 billion.

The foundation prioritises education, scientific research, public health, and access to technology, with particular attention to institutions connected to Huang’s personal history.

| Year | Institution | Donation | Focus |

|---|---|---|---|

| 2019 | Oneida Baptist Institute | $2M | Education facilities |

| 2022 | Oregon State University | $50M | AI research complex |

| 2024 | Stanford University | $30M | Engineering innovation |

| 2025 | California College of the Arts | $22.5M | Campus development |

These contributions increasingly shape how Huang’s legacy will be evaluated beyond market capitalisation alone.

Final Perspective

Jensen Huang’s estimated $164 billion net worth in 2026 is not the result of trend-chasing or financial engineering. It reflects decades of consistent technical judgment, an early understanding of parallel computing, and the ability to position NVIDIA at the centre of the AI economy before its value was widely recognised.

As artificial intelligence becomes embedded into national infrastructure, healthcare systems, and industrial automation, Huang’s influence will extend well beyond corporate leadership. His wealth is a byproduct of that influence, not the defining feature of it.

Frequently Asked Questions About Jensen Huang

What companies has Jensen Huang invested in outside NVIDIA?

While most of Huang’s wealth is tied to NVIDIA, he is known to support startups in AI and computing through donations and strategic investments, primarily via his foundation.

How much of NVIDIA does Jensen Huang currently own?

As of 2026, Huang owns approximately 3.6% of NVIDIA’s outstanding shares, making him one of its largest individual shareholders.

What major tech events has he spoken at recently?

In the last two years, Huang has delivered keynotes at CES 2025 and Computex 2025, announcing major product lines and speaking about the future of AI.

Does Jensen Huang hold any patents or technical credits?

Yes, Huang has contributed to several chip design and GPU-related patents from NVIDIA’s early development stages.

How has his foundation supported education initiatives?

His foundation has made major donations to Oregon State University, Stanford, and Oneida Baptist Institute, promoting STEM education and innovation.

Is Jensen Huang involved in politics or government advisory?

While not overtly political, Huang often consults with global leaders on AI, including attending meetings with figures like Indian PM Narendra Modi.

What is his leadership style like at NVIDIA?

Known for a hands-on and open-door style, Huang maintains 60+ direct reports and favours a flat organisational structure. He is often described as intensely driven yet humble.