Table of Contents

Introduction

The cost of living in the United Kingdom is increasing in the UK. Numerous factors contributed to the rise of living in the UK. The COVID-19 stagnation can be one of the reasons that contributed to decreasing propensity of the people. But the good news is that the markets are rising once again, and they are making the best use of the resources to come out strong in the markets.

Do you want to move to the UK to study or join a job? In both cases, you have to be cautious. Recent studies tell that inflation has battered the markets. According to the study and observation of Statista, the average spending of households in the UK has increased manifolds.

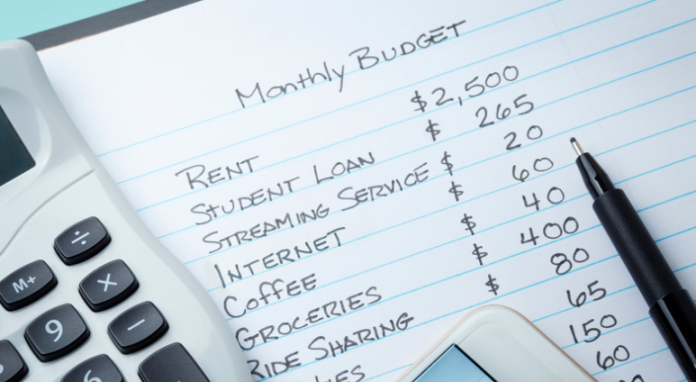

Around 70% of the households in the UK reported that their cost of living has increased compared to the previous month. The value was around 62% in early November. Therefore, you ought to look at the budget, the weekly, monthly or yearly expenditures. This very article can help you gather a comprehensive idea of the average monthly expenses when living in the UK.

Average Monthly Expenditure In The UK

London is undoubtedly an expensive city for visitors. According to recent studies, the cost of living in London is way more than the average cost of living globally. Therefore if you need to live in the UK in general or, say, London in particular, you need to prepare a budget. A financial advisor may help you with budgetary control. So in this article, we study the budget and the monthly expenses while living in the UK.

1. Accommodation

The average cost of living in the UK for four people is around £4,000 and £4,500, and that includes the rent. If you stay in London, the centre of all the amenities, you will have to spend more. But if you are prepared to stay in the suburbs, you can better manage your finances.

The average cost of living in the UK for four people is around £4,000 and £4,500, and that includes the rent. If you stay in London, the centre of all the amenities, you will have to spend more. But if you are prepared to stay in the suburbs, you can better manage your finances.

Now if you and your friend are staying in the UK, the cost of living would be around £1000 to £1600, including the rent. Again, it can be different depending on where you live. Hence it can be said that the monthly expenditure for accommodation can range between £500-£700.

2. Transportation

The transportation costs in the UK are quite high, so you have to chalk out your planning properly to handle the budget. If you superimpose the budget over the UK average salary, you can understand that you have to pay quite heavily for transportation.

The monthly pass cost on the railway costs £65. The one-way ticket is £2.5. If you consider commuting with the help of a taxi, you have to bear the extra cost. According to studies, the Taxi fare starts at approximately £2.8 approximately. So if you consider the monthly transportation charges, it can go to more than £40 for a person.

3. Study Cost In The UK

The UK offers one of the best education systems in the whole world. With top-class universities and state-of-the-art infrastructure, institutions offer the best service to cater to the requirements of the students. If you study at a University, you must pay around £9500 to £10000. This is the average tuition fee.

The UK offers one of the best education systems in the whole world. With top-class universities and state-of-the-art infrastructure, institutions offer the best service to cater to the requirements of the students. If you study at a University, you must pay around £9500 to £10000. This is the average tuition fee.

The fees will vary according to the subject for sure. Different universities offer their services to students with different facilities like laboratory facilities if you are studying in the science stream. The cost will be less if you study humanities-based subjects. If you combine all of them, the average cost turns out to be around £12500. Herefrom, you can get the average monthly cost. It was a little over £1200.

Students in the UK can use college IDs to get various discounts. But it is not the case with foreign students. They will have to bear the expenses. So the average monthly cost of education will not be the same for UK students and those coming from abroad for higher education.

4. Utilities And Bills In The UK

In the UK, the average fuel cost is around £1331 per year. The average cost of electricity yearly is £3840. The cost of water and other sewage bills per year is around £400. Finally, the internet’s average cost, or broadband, can range between £27 to £30 depending on the brand and its facilities.

These costs are important from the point of view of staying in any place. So the monthly costs of the utilities can range between £1500 to £2000. You must remember this before you plan to stay in the UK.

These are basic expenses, and you can not avoid them under any circumstances. At the same time, you must ensure that you cut down the expenditure, which is not necessary.

5. Entertainment

You can not simply do your work and sit duck; you also have to spend on the entertainment section. Restaurant and cafe costs are also the major costs that you have to bear.

You can not simply do your work and sit duck; you also have to spend on the entertainment section. Restaurant and cafe costs are also the major costs that you have to bear.

For instance, the meals and the normal restaurants can cost you around £12. Now if you visit a mid-range outdoor restaurant with two people, your average cost would be around £50. McDonald’s Meals are an important part of entertainment. Even a McDonald’s meal could cost around £6.

Now let’s come to some other sections of entertainment. Fitness centres would cost around £30.72. If you hire a tennis court, you may have to bear £10.24. Keep at least £10 for the movie theatres. This way, you easily aggregate the monthly fees for this section. So you can easily calculate a monthly budget in this section.

Is Anything Else To Consider?

Things you can consider under the expenditure include a monthly visa and immigration charges, and you have to pay around £1334 per month. After you aggregate all the expenditures, as mentioned earlier, you have to add another £200 to £300.

This is the way you can prepare your budget. You can subtract the education fees if you have come for a job. But the budget amount would not differ much from what we calculated here.